The Unified Payments Interface (UPI) has transformed India’s financial landscape by simplifying, speeding up, and increasing accessibility to digital transactions. BanknYou, a fintech startup that promises to make banking products such as credit cards, debit cards, accounts, and payment administration easier for small and medium-sized businesses (SMEs), sees substantial prospects in UPI advances.

Recent Developments in UPI

- UPI Lite: The launch of UPI Lite has made transactions even more convenient for users, particularly those in places with limited internet access. UPI Lite enables small-value transactions to be handled offline, providing smooth payments even when the network is weak. For SMEs operating in rural and isolated places, UPI Lite can be a game changer, allowing them to conduct business without worrying about connectivity concerns.

- Empowering Businesses with UPI Lite: UPI AutoPay enables recurring payments like subscriptions, insurance premiums, and utility bills. Businesses may now automate their payment procedures, eliminating the need for manual intervention and lowering the risk of missed payments. This tool has the potential to greatly increase operational efficiency in SMEs that manage several transactions.

- Internationalization of UPI: Another notable aspect is UPI’s spread beyond Indian borders. The NPCI has been working on enabling UPI for cross-border payments, which will allow businesses to effortlessly deal with overseas clients and suppliers. This is especially useful for SMEs wishing to expand their global reach because it simplifies the process of accepting and transferring foreign payments.

- UPI 2.0: It includes various improvements, including the ability to link overdraft accounts, mandate features, and invoices in the inbox. These features give SMEs more freedom in managing their finances. For example, the option to link overdraft accounts enables businesses to easily acquire credit, allowing them to better manage their cash flow.

- UPI on Feature Phones: As part of the UPI123Pay project, UPI is now available on feature phones to help bridge the digital divide. Users without smartphones can now access UPI services through IVR, missed calls, and SMS-based services. This advancement assures that SMEs in remote areas, where smartphones are not widely available, can still benefit from UPI’s convenience and security.

- Integration with E-commerce Platforms: UPI’s integration with major e-commerce platforms has increased its usability for small enterprises. Small and medium-sized enterprises can now accept UPI payments on their websites and apps, making it easier for clients to pay for products and services. This integration not only improves the client experience but also allows businesses to streamline their payment operations.

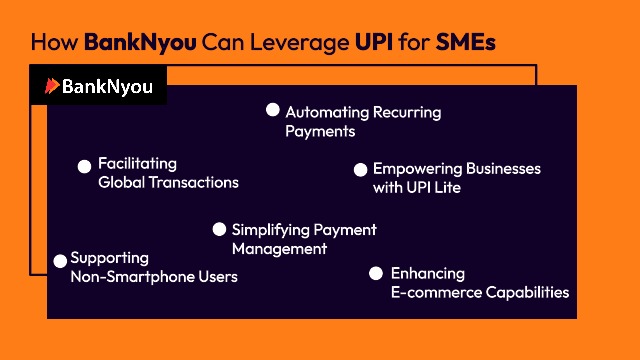

How BanknYou Can Leverage UPI for SMEs

BanknYou understands the unique issues that SMEs and small companies confront, particularly in rural and remote locations. The advances in UPI give us an excellent chance to expand our solutions and assist our clients in attaining their business objectives.

- Simplifying Payment Management: UPI’s advancements allow us to offer a one-stop-shop solution for all financial needs. Through our app and website, SMEs can manage their payments, from banking to remittances, money transfers, and utility payments, all in one place. The integration of UPI ensures that these transactions are fast, secure, and convenient.

- Empowering Businesses with UPI Lite: For businesses in areas with limited internet connectivity, UPI Lite can be a lifesaver. By incorporating UPI Lite into our platform, we can ensure that our clients can continue to operate smoothly, even in the most remote locations. This feature aligns with our mission to empower SMEs and small businesses across rural and remote areas.

- Automating Recurring Payments: UPI AutoPay is a valuable tool for SMEs looking to automate their payment processes. By offering this feature through our platform, we can help businesses reduce the time and effort spent on managing recurring payments. This not only improves efficiency but also allows businesses to focus on their core operations.

- Facilitating Global Transactions: As UPI expands internationally, BanknYou can help SMEs tap into global markets. By integrating cross-border UPI payments into our platform, we can simplify the process of conducting international transactions. This opens up new opportunities for SMEs to grow and scale their businesses beyond India’s borders.

- Supporting Non-Smartphone Users: We recognize that not all of our clients may have access to smartphones. By offering UPI123Pay through our platform, we can ensure that even businesses using feature phones can benefit from UPI’s capabilities. This inclusivity is key to our commitment to serving SMEs and small businesses, regardless of their technological resources.

- Enhancing E-commerce Capabilities: With the integration of UPI into e-commerce platforms, BanknYou can help SMEs expand their online presence. By enabling UPI payments on their websites and apps, we can help businesses attract more customers and increase their sales. This aligns with our goal of helping SMEs leverage online business opportunities.

The Future of UPI and BanknYou’s Role

For SMEs and small businesses, staying ahead of these advancements is critical to success. BanknYou is devoted to staying ahead of these changes and providing our clients with the most up-to-date and creative financial solutions.

We believe that UPI’s continued advances will have a substantial impact on the way SMEs and small firms manage their funds. By incorporating these advancements into our platform, we can help our clients function more efficiently, reach new markets, and ultimately achieve their business objectives.

Finally, improvements in UPI hold enormous potential for SMEs and small companies, particularly those working in rural and remote areas. At BanknYou, we are delighted to harness these improvements to offer our clients a comprehensive, user-friendly, and secure banking platform. Whether it’s simplifying payment administration, facilitating global transactions, or assisting non-smartphone users, we’re here to help SMEs traverse the digital financial landscape and survive in today’s competitive environment.